When Kevin contacted me about doing a blog post for Sunshine and Munchkins, I was thrilled because I love having people share their knowledge on subjects they are passionate about. Today, Kevin is sharing some tips for how to create a monthly budget. Check it out below!

*****

With all the demands of running a family, we sometimes push aside the task of creating a monthly budget – especially when we feel that not looking at our financial situation removes the fears of having the tough conversation of where we stand financially. Creating a budget can sometimes be frustrating, especially if you have never created one, or you are a bit rusty due to pushing it off for so long.

It isn’t uncommon for every couple to experience the same thing we had. But in most situations, the budget just doesn’t get created in the first place. You may see that you haven’t created a budget and think “We’re doing fine” without one. But in the long run, if you don’t tell your money what to do, you won’t ever know where your money went. I know that creating a budget can sometimes be frustrating, especially if you working with a spouse or partner to create one. So to help you get started, here are a few things you can do to make the process simpler.

5 Basic Tips to Create Your Budget

Choose Your Budget Style Are you going to use paper or software? Using a pen and paper can be just as effective as using an electronic budgeting solution. Of course, a financial software makes the job easier and can reduce errors.

Don't Wait Until the Month Has Started Pick a time towards the end of the month to set up your budget. If you have a spouse or partner, be sure to include them in the process. If both parties aren't on board, it is likely your budget will fail. Try setting up a date night, have some treats and prepare the budget together.

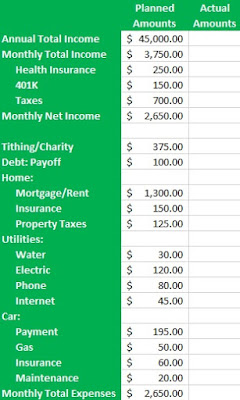

Having categories set up allows you to determine how much money you will be spending in each category. Make sure that every dollar is spent in each of your categories. If you have some extra money left when you have allocated money for each category, you shouldn't think this is extra money to go and spend and not have to account for it. If you want to blow it, then create a category for blowing it. At least things way, you are accountable for where the money went.

Track Your Expenses to Know Where Your Money Went Just because it is called a monthly budget doesn't mean that you should only review it once a month. Keep tabs on your spending so you know how you are doing. If you had to spend $150 extra on car maintenance, call an emergency budget meeting and discuss where that $150 is going to come from. Remember the coined phrase "Robbing Peter to pay Paul"? That is exactly what needs to be done.

One of the most important things to do is be honest with yourself when it comes to your finances. Don’t pretend that everything is OK if it isn’t. A little secret to keep in mind; for the first couple of months you’re going to be off on your budget. It is OK. Don’t lose it and say I am done with this. The more often you sit down and work on your budget together as a family, the easier it will become and you will nail it going forward.

Kevin is the creator behind Smart Credit University, where he coaches individuals and families on how they can repair their financial past and take control of their financial future. Kevin is the husband to a beautiful wife, and father to two girls and is expecting his first son. You can read more about Kevin and what he is doing at his blog Smart Credit University.

No comments